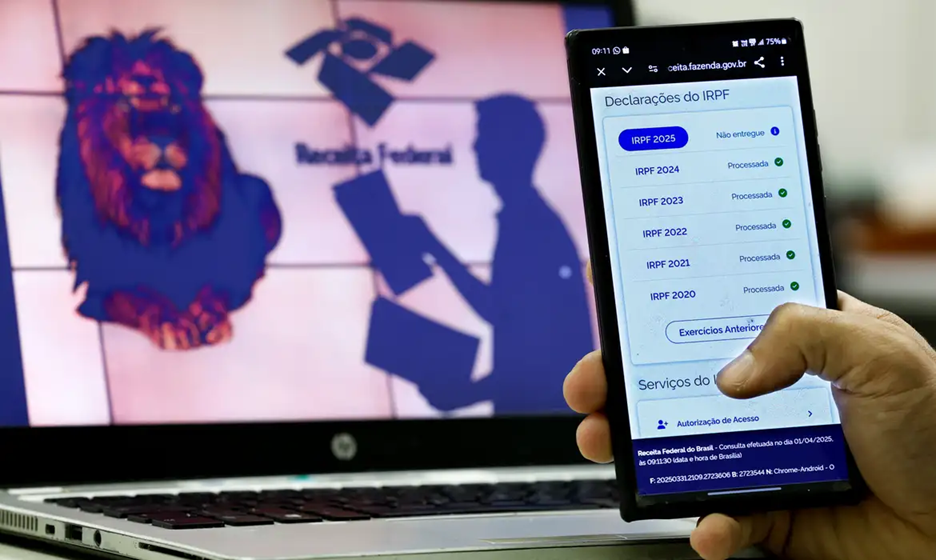

The government of Brazilian President Lula has issued Provisional Measure No. 1,294, raising the tax exemption threshold for personal income tax to 3,036 reais, which is twice the minimum wage. This measure will take effect in May 2025. According to the Ministry of Finance, this adjustment will make individuals with monthly incomes below twice the minimum wage completely exempt from income tax. The new personal income tax threshold is set at 2,428 reais, with a simplified deduction of 607.20 reais, ensuring that those with monthly incomes not exceeding 3,036 reais will no longer pay personal income tax. This policy aims to reduce the burden on low-income groups while also reducing the tax burden on high-income individuals.

The Brazilian National Tax Authority estimates that this policy will lead to a revenue loss of 3.29 billion reais in 2025, decreasing to 5.34 billion reais in 2026 and 5.73 billion reais in 2027. The government has proposed a bill to further raise the tax exemption threshold to 5,000 reais, aiming to achieve fiscal balance through increased taxation on high-income earners and taxing overseas dividends.

Furthermore, the government plans to adjust the minimum wage standard in 2026, increasing it from 1,518 reais to 1,627 reais, representing a growth of approximately 7.18%. This adjustment will also take into account the inflation rate and GDP growth rate. Finance Minister Fernando Haddad stated that despite economic pressures, the fiscal targets for 2026 remain unchanged, aiming for a primary surplus of 0.25% of GDP. The government has also set surplus targets for the coming years.

Through expanding the tax exemption threshold, raising the minimum wage level, and promoting a more progressive tax system, the Brazilian government aims to alleviate the pressure on people's lives, stimulate economic vitality, and create conditions for sustainable fiscal development.